Form W-4 is an important document for employees and employers alike. It is used to determine how much federal income tax should be withheld from an employee’s paycheck. Understanding how to fill out the form correctly is crucial to ensure accurate tax withholding. In this article, we will discuss the basics of Form W-4 and provide information on how to fill it out for the year 2022.

What is Form W-4?

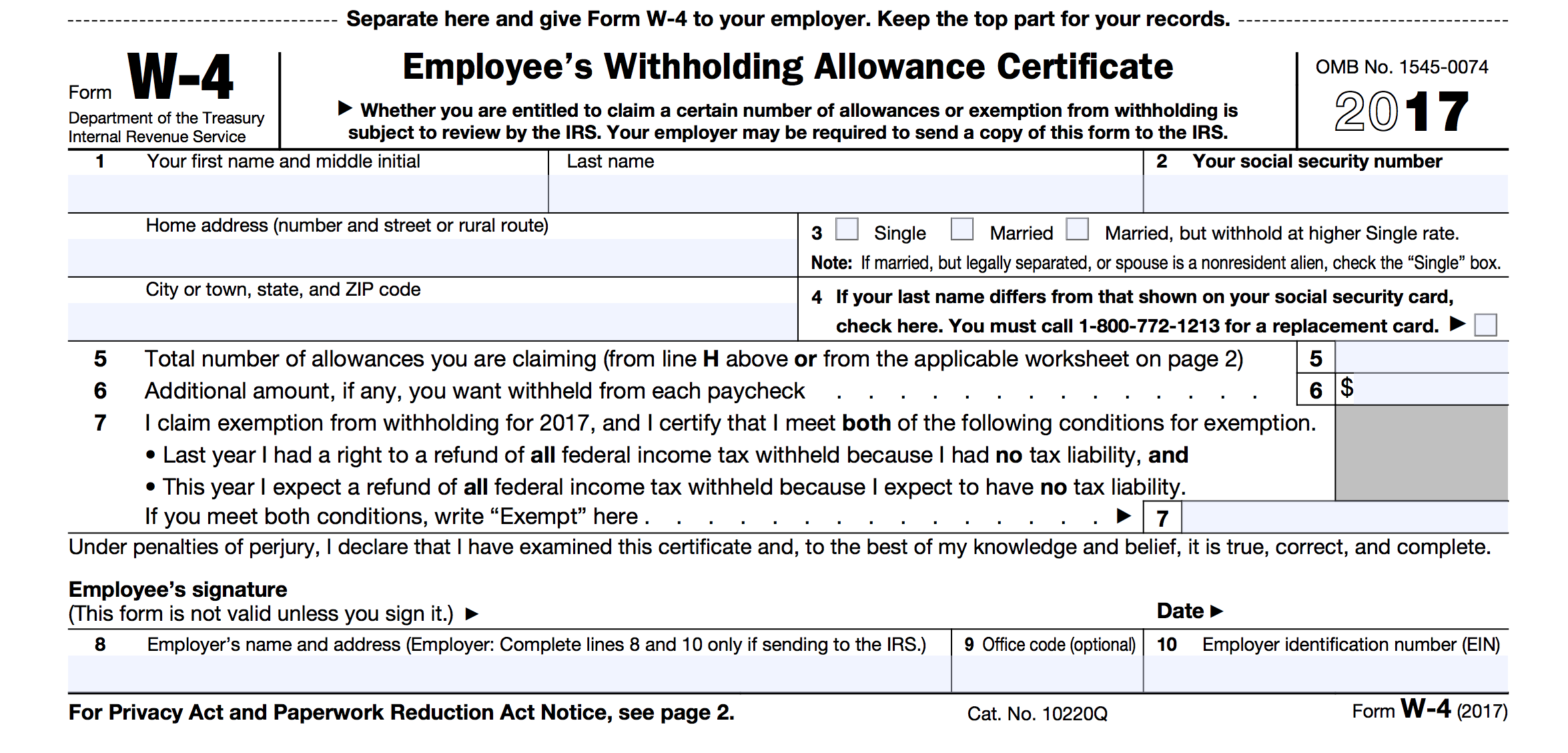

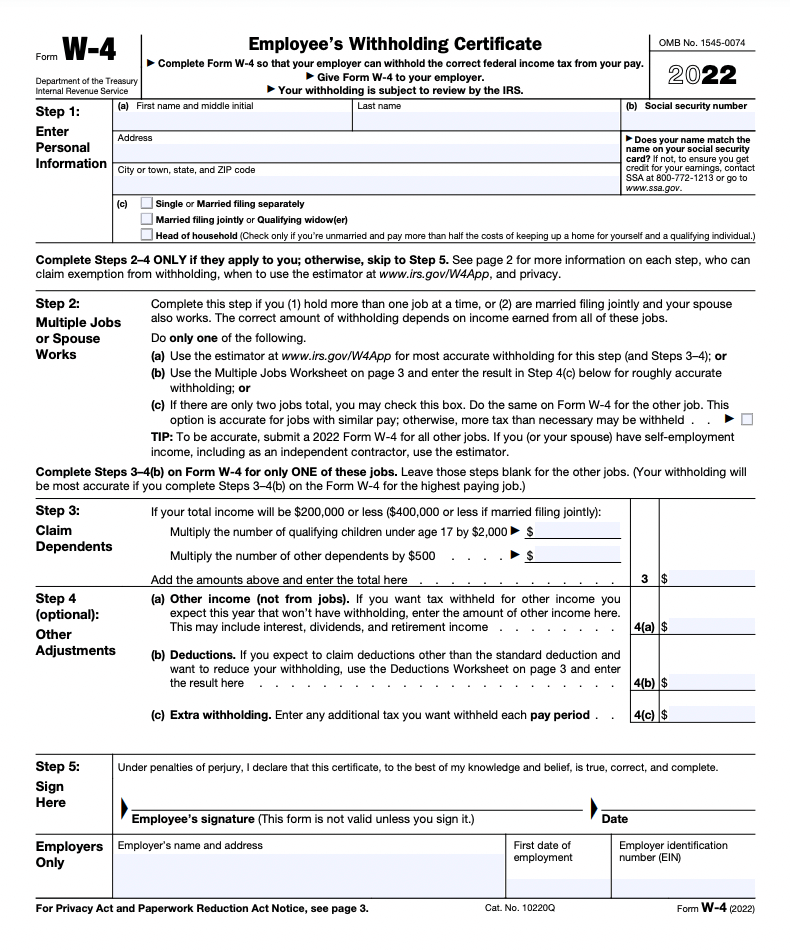

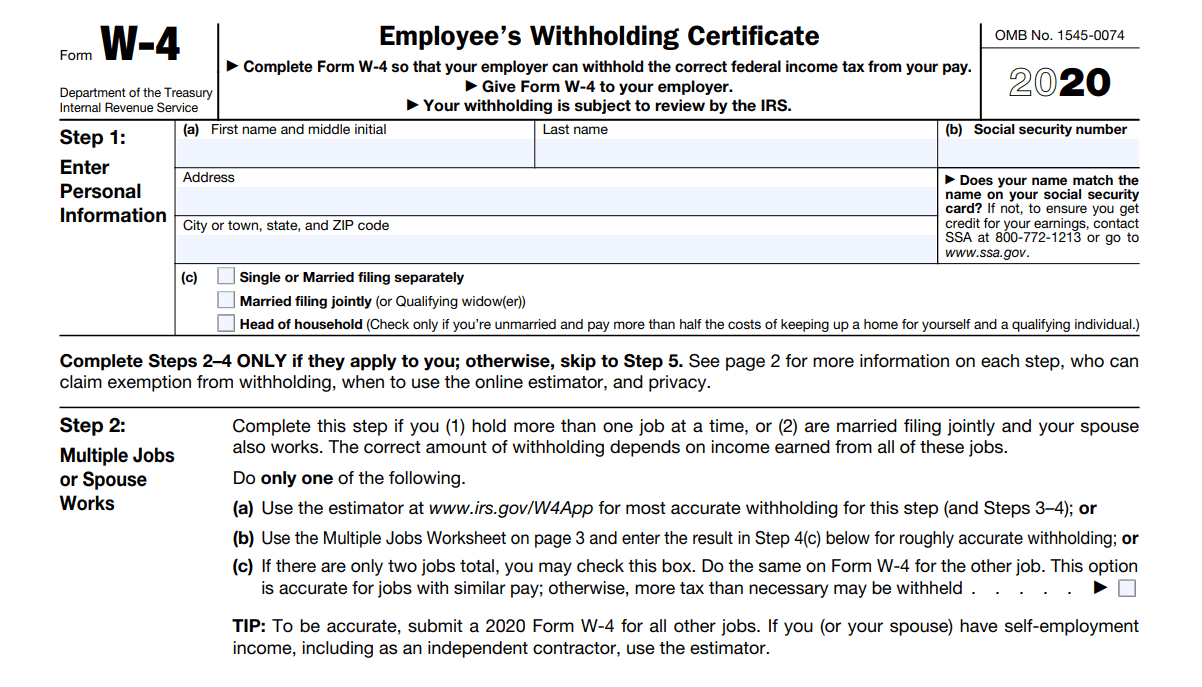

Form W-4, also known as the Employee’s Withholding Certificate, is a federal tax form used by employees to inform their employers how much federal income tax should be withheld from their paychecks. The form includes personal information such as name, Social Security number, and filing status. It also requires employees to provide details about their dependents and any additional income they may have.

It is important to note that Form W-4 is not a one-time document. It should be filled out whenever there are changes in an employee’s personal or financial situation. This could include getting married, having a child, or taking on a second job.

Filling out Form W-4 for 2022

If you are an employee and need to fill out Form W-4 for the year 2022, there are a few steps you should follow:

Step 1: Provide your personal information. This includes your name, address, and Social Security number.

Step 1: Provide your personal information. This includes your name, address, and Social Security number.

Step 2: Choose your filing status. The options are single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

Step 3: Determine the number of allowances you are claiming. An allowance is a predetermined amount that reduces the amount of your income subject to withholding. The more allowances you claim, the less tax will be withheld from your paycheck.

Step 4: If you have multiple jobs or your spouse also works, you may need to use the multiple jobs worksheet provided with Form W-4 to accurately determine your withholding.

Step 5: If you have dependents, you may be eligible for the Child Tax Credit or other credits. You can claim these credits on Form W-4.

Step 5: If you have dependents, you may be eligible for the Child Tax Credit or other credits. You can claim these credits on Form W-4.

Step 6: If you have additional income that is not subject to withholding, such as self-employment income or rental income, you may need to make estimated tax payments or request additional withholding.

Step 7: Sign and date the form.

It is important to keep in mind that the information you provide on Form W-4 will affect the amount of federal income tax withheld from your paycheck. If you do not have enough tax withheld, you may owe taxes when you file your return. On the other hand, if too much tax is withheld, you may receive a refund.

It is important to keep in mind that the information you provide on Form W-4 will affect the amount of federal income tax withheld from your paycheck. If you do not have enough tax withheld, you may owe taxes when you file your return. On the other hand, if too much tax is withheld, you may receive a refund.

Additional Considerations

It is recommended to review and update your Form W-4 periodically, especially if you experience significant life changes such as getting married, having a child, or changing jobs. In addition, you can use the IRS withholding calculator to ensure that your withholding is accurate.

Remember, it is your responsibility as the employee to provide accurate and up-to-date information on Form W-4. Failure to do so may result in incorrect tax withholding and potential penalties. If you are unsure about how to fill out the form or whether you are claiming the correct number of allowances, it may be helpful to consult with a tax professional.

Remember, it is your responsibility as the employee to provide accurate and up-to-date information on Form W-4. Failure to do so may result in incorrect tax withholding and potential penalties. If you are unsure about how to fill out the form or whether you are claiming the correct number of allowances, it may be helpful to consult with a tax professional.

In conclusion, Form W-4 is an essential document for employees to ensure accurate federal income tax withholding. By understanding how to fill out the form correctly and keeping it updated, you can avoid any surprises when tax season arrives.