In today’s digital age, it is essential for all individuals and businesses to stay updated with the latest tax regulations. One crucial document that plays a significant role in the tax filing process is the W-9 form. Whether you are an employee or an independent contractor, understanding the purpose and importance of the W-9 form is vital.

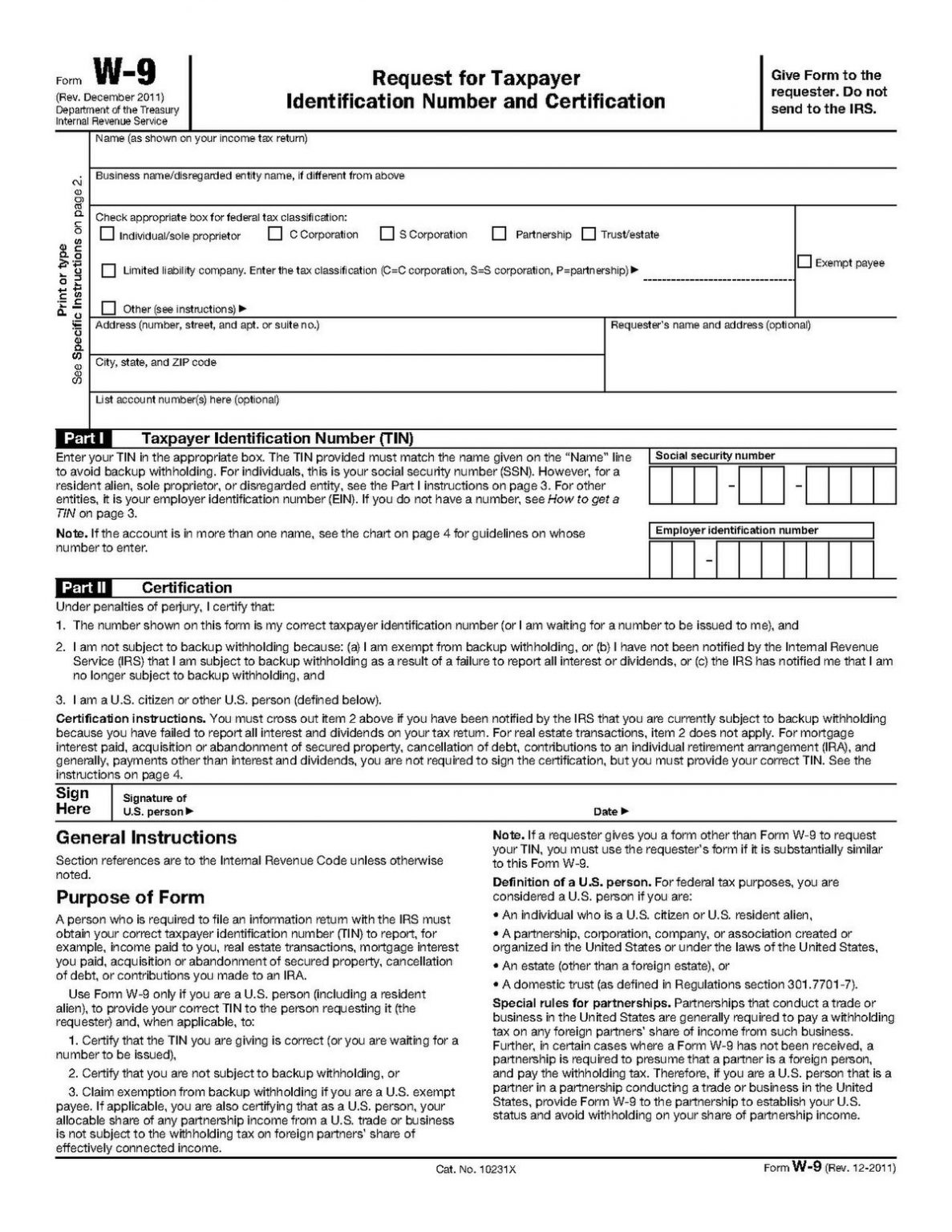

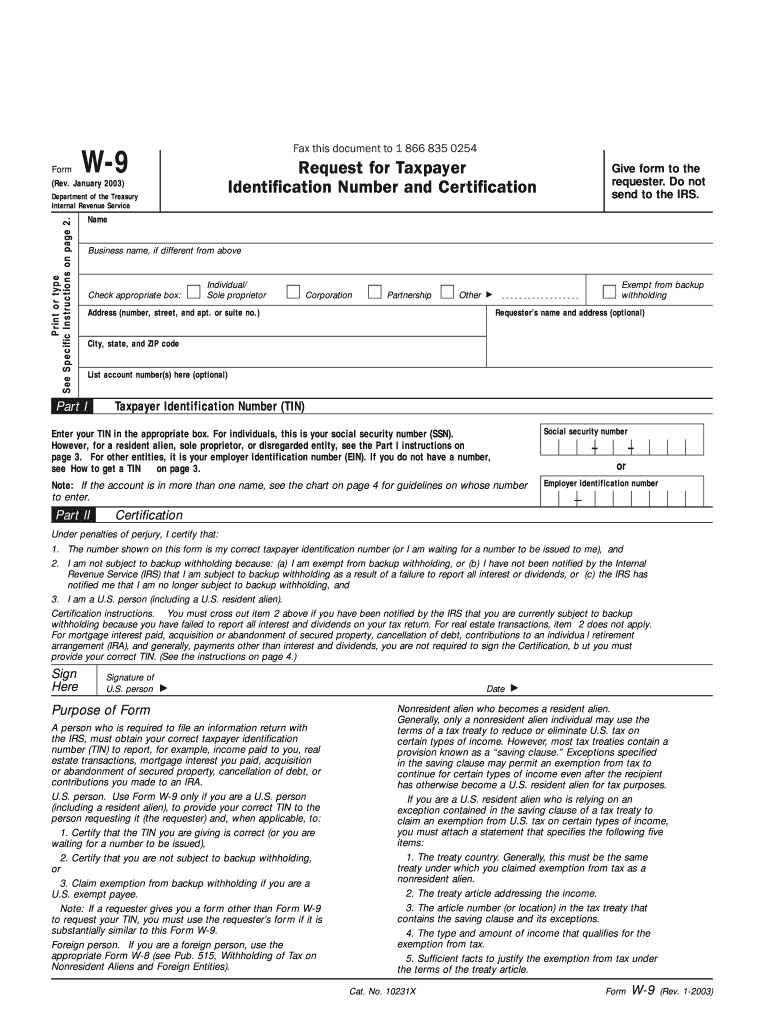

W 9 Printable Form 2022

The W 9 Printable Form for the year 2022 provides a convenient way to submit your tax information accurately. This printable form includes all the necessary fields required by the Internal Revenue Service (IRS) to identify and verify the taxpayer’s information. By filling out this form and providing accurate details, you ensure that your tax filings are compliant with the current regulations and prevent any potential errors.

The W 9 Printable Form for the year 2022 provides a convenient way to submit your tax information accurately. This printable form includes all the necessary fields required by the Internal Revenue Service (IRS) to identify and verify the taxpayer’s information. By filling out this form and providing accurate details, you ensure that your tax filings are compliant with the current regulations and prevent any potential errors.

Blank Printable W9 Form

If you prefer a blank printable W9 form, you can easily find templates online. This allows you to fill in the required information manually. Many individuals and businesses find this option convenient, as it provides flexibility and allows for customization based on specific needs. With a printable W9 form, you have the freedom to complete the document at your own pace and have a physical copy for your records.

If you prefer a blank printable W9 form, you can easily find templates online. This allows you to fill in the required information manually. Many individuals and businesses find this option convenient, as it provides flexibility and allows for customization based on specific needs. With a printable W9 form, you have the freedom to complete the document at your own pace and have a physical copy for your records.

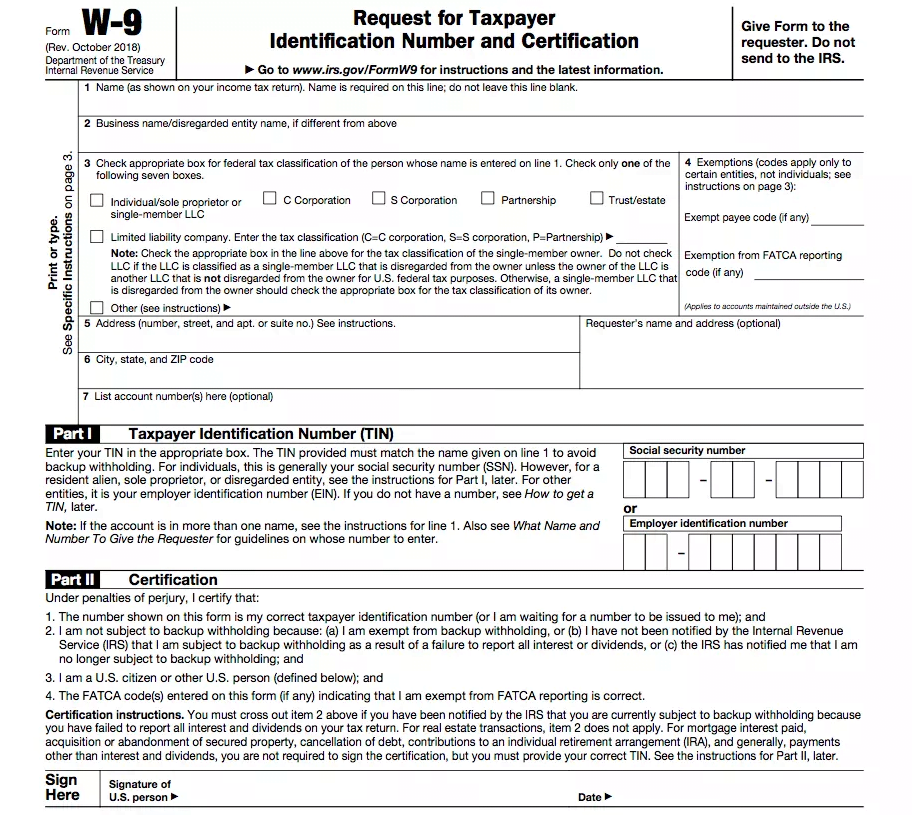

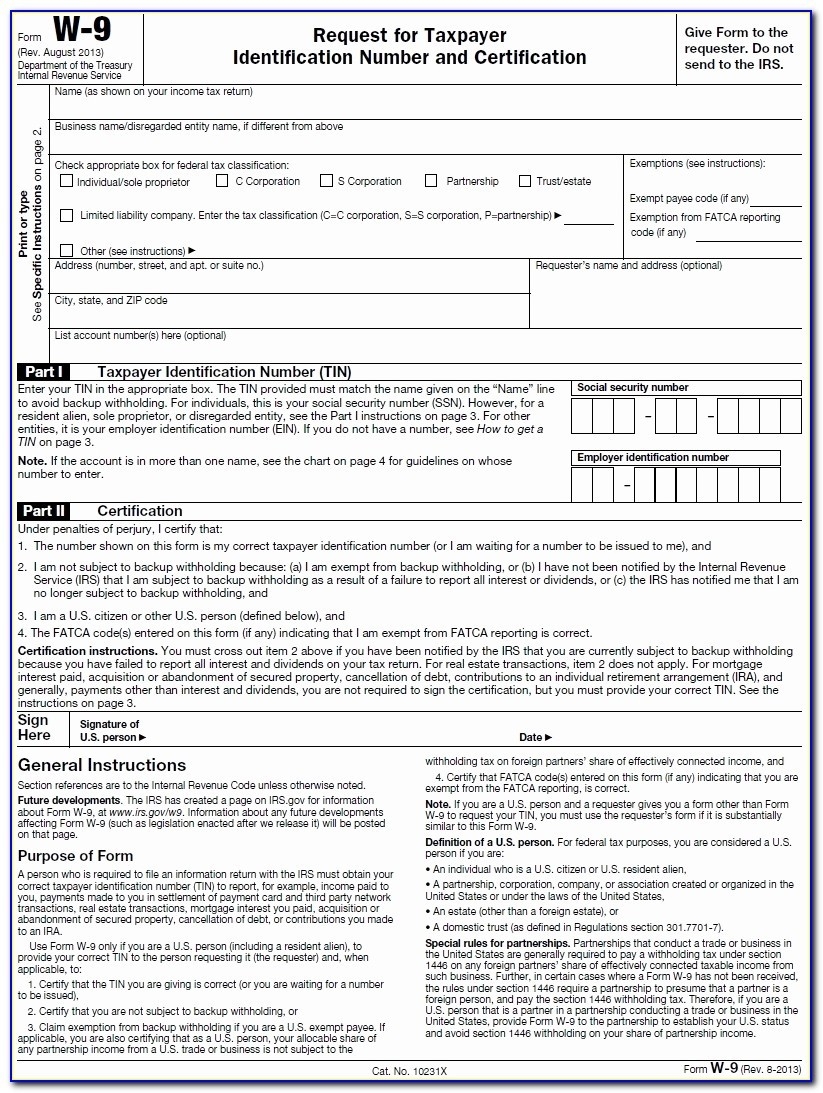

W9 Form 2022

The W9 form for the year 2022 is an essential document for both individuals and businesses. It is used to request the taxpayer identification number (TIN) from individuals and entities that may be subject to backup withholding. The form includes sections for personal information, such as name and address, as well as a section to enter your TIN. By providing accurate information on the W9 form, you ensure that your earnings are properly reported to the IRS and avoid any potential penalties or issues during the tax filing process.

The W9 form for the year 2022 is an essential document for both individuals and businesses. It is used to request the taxpayer identification number (TIN) from individuals and entities that may be subject to backup withholding. The form includes sections for personal information, such as name and address, as well as a section to enter your TIN. By providing accurate information on the W9 form, you ensure that your earnings are properly reported to the IRS and avoid any potential penalties or issues during the tax filing process.

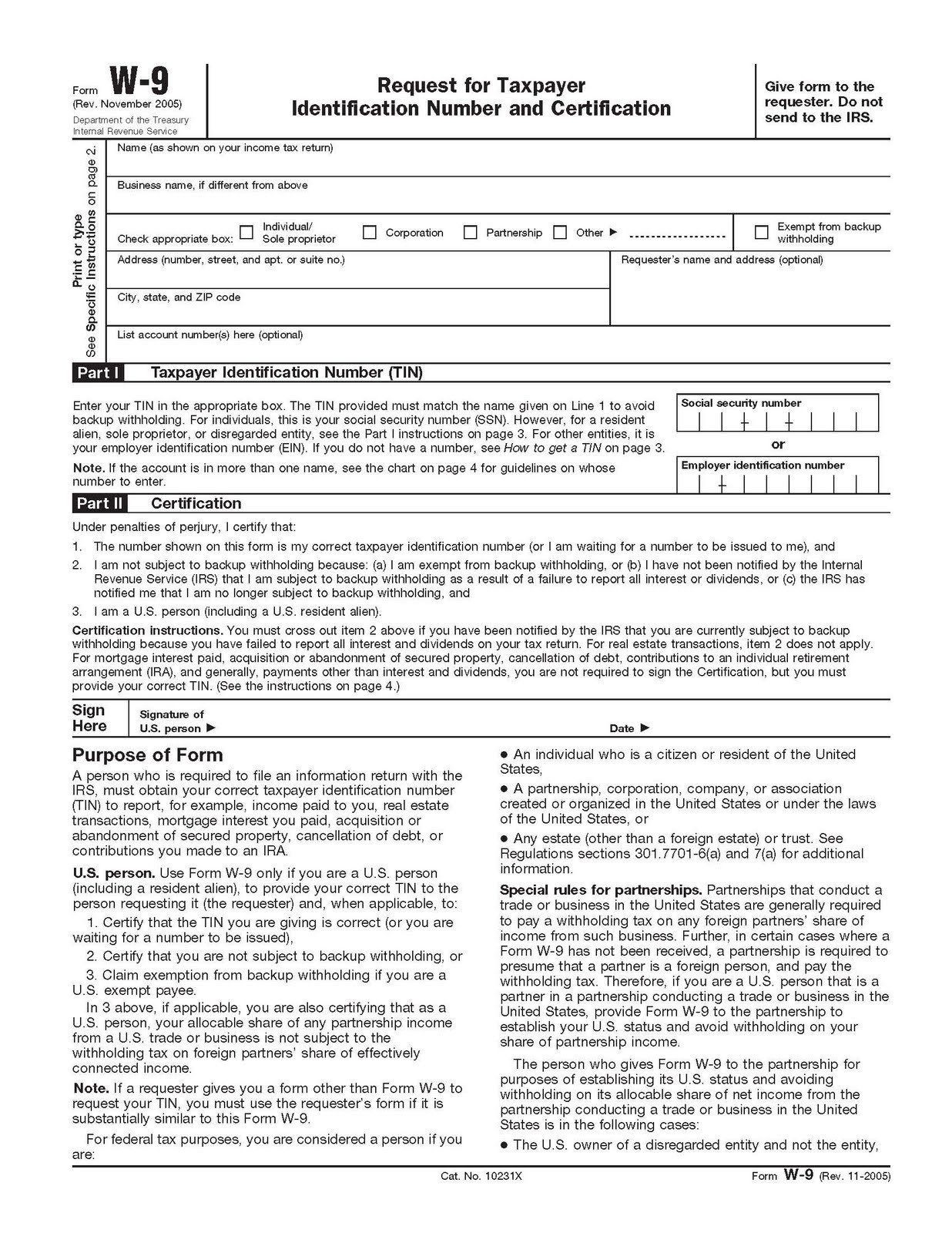

Blank W 9 Form 2020 Printable

Even though we are currently in 2022, there may still be instances where you need to refer to the previous year’s tax forms. A blank W 9 form for the year 2020 is readily available for printing and filling out manually. It is crucial to ensure that you are using the correct year’s form when submitting your tax information. By having access to a printable W 9 form for 2020, you can easily provide accurate information for any previous year’s tax filings.

Even though we are currently in 2022, there may still be instances where you need to refer to the previous year’s tax forms. A blank W 9 form for the year 2020 is readily available for printing and filling out manually. It is crucial to ensure that you are using the correct year’s form when submitting your tax information. By having access to a printable W 9 form for 2020, you can easily provide accurate information for any previous year’s tax filings.

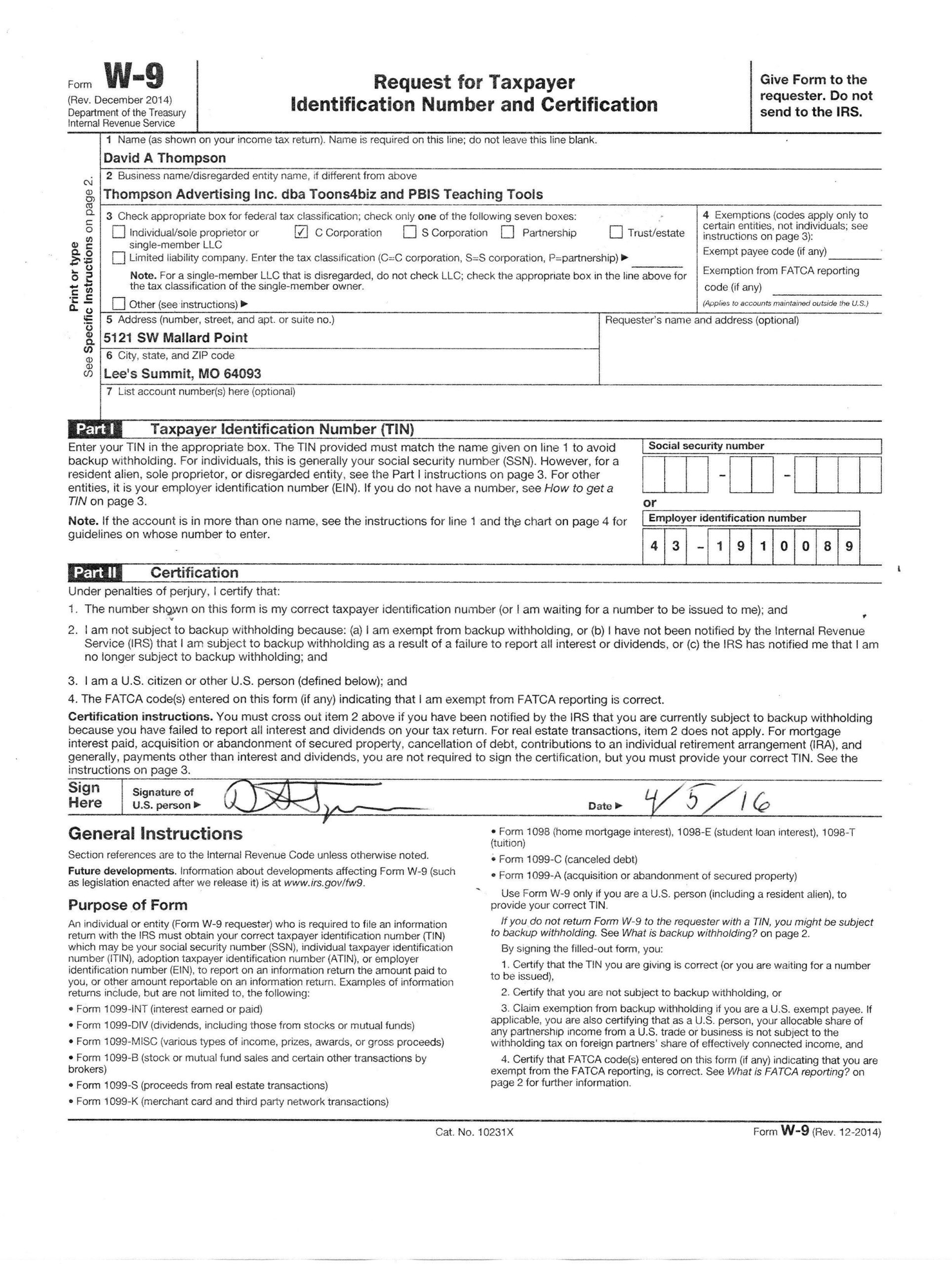

Blank w 9 form: Fill out & sign online

If you prefer a more convenient and digital approach, you can utilize online platforms to fill out and sign the W 9 form. With the advancements in technology, online platforms provide a user-friendly interface that allows you to input all the necessary information seamlessly. By filling out the form digitally, you also eliminate the need for physical paperwork and have a digital copy readily available for future reference.

If you prefer a more convenient and digital approach, you can utilize online platforms to fill out and sign the W 9 form. With the advancements in technology, online platforms provide a user-friendly interface that allows you to input all the necessary information seamlessly. By filling out the form digitally, you also eliminate the need for physical paperwork and have a digital copy readily available for future reference.

Blank W-9 Form 2020 Printable

For the year 2020, individuals and businesses may still need to refer to the blank W-9 form. This printable form allows you to provide accurate information required by the IRS for tax purposes. It is essential to carefully fill out the form to ensure that your tax filings are accurate and compliant with the IRS regulations. By utilizing a printable W-9 form for the year 2020, you can provide the necessary information for any previous year’s tax obligations.

For the year 2020, individuals and businesses may still need to refer to the blank W-9 form. This printable form allows you to provide accurate information required by the IRS for tax purposes. It is essential to carefully fill out the form to ensure that your tax filings are accurate and compliant with the IRS regulations. By utilizing a printable W-9 form for the year 2020, you can provide the necessary information for any previous year’s tax obligations.

Printable W-9 Form 2020 - Fillable IRS W-9 Form

Another option to consider when completing the W-9 form is utilizing a fillable IRS W-9 form available online. These forms allow you to enter your information directly on the online platform, making the process quick and efficient. By using a fillable W-9 form, you eliminate the need for printing and scanning, as you can digitally sign the form and submit it electronically. This online approach to completing the W-9 form provides convenience and saves time for both individuals and businesses.

Another option to consider when completing the W-9 form is utilizing a fillable IRS W-9 form available online. These forms allow you to enter your information directly on the online platform, making the process quick and efficient. By using a fillable W-9 form, you eliminate the need for printing and scanning, as you can digitally sign the form and submit it electronically. This online approach to completing the W-9 form provides convenience and saves time for both individuals and businesses.

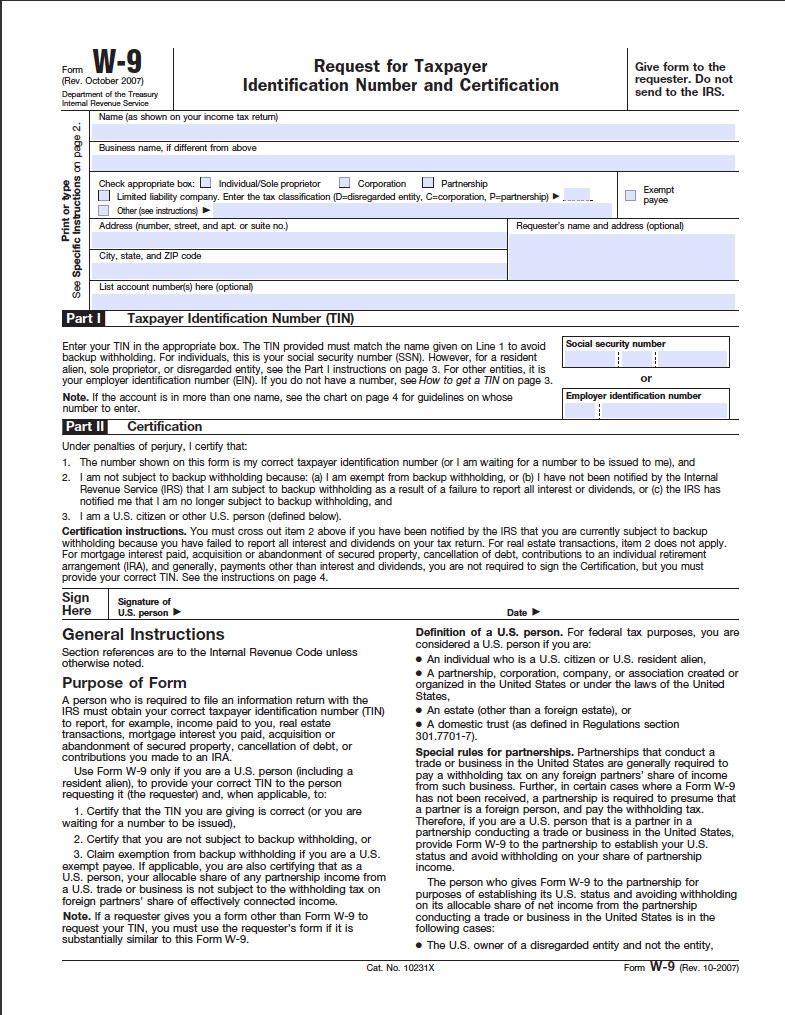

Blank W9 Form For 2021

For the year 2021, having access to a blank W9 form is crucial for individuals and businesses. This printable form allows you to provide accurate tax information as per the IRS guidelines. By filling out the W9 form for 2021, you ensure that your earnings and tax liability for that specific year are properly reported. It is important to stay updated with the latest tax forms to ensure compliance with the IRS regulations and avoid any potential penalties or issues during the tax filing process.

For the year 2021, having access to a blank W9 form is crucial for individuals and businesses. This printable form allows you to provide accurate tax information as per the IRS guidelines. By filling out the W9 form for 2021, you ensure that your earnings and tax liability for that specific year are properly reported. It is important to stay updated with the latest tax forms to ensure compliance with the IRS regulations and avoid any potential penalties or issues during the tax filing process.

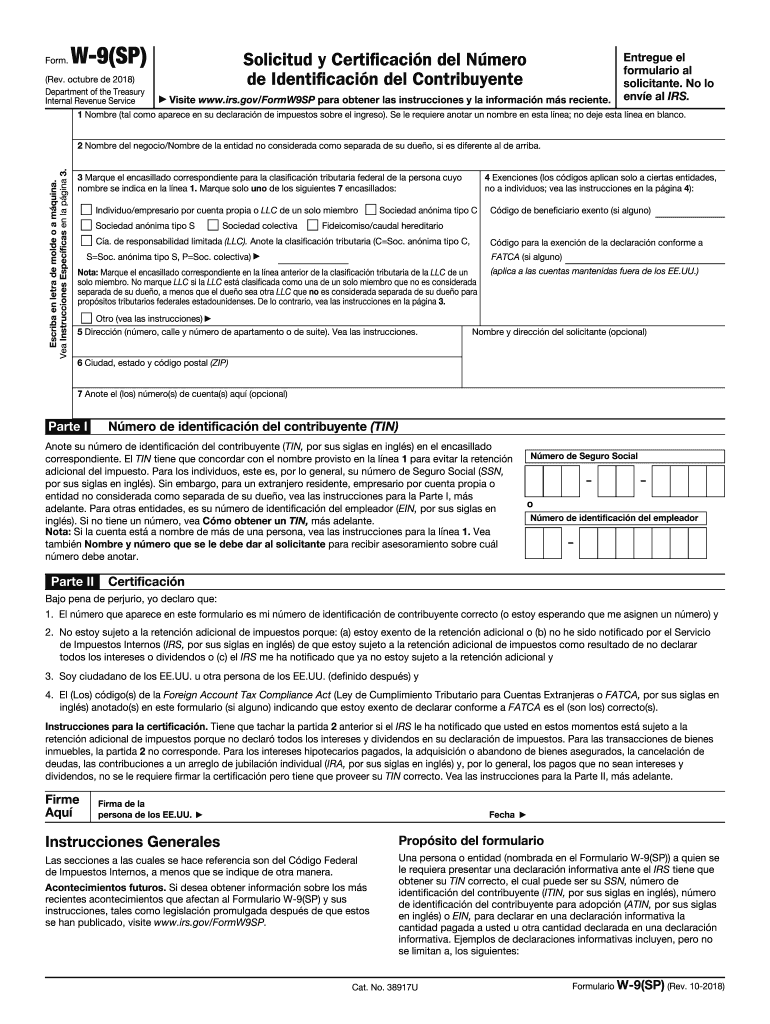

2018-2023 con los campos en blanco IRS W-9(SP)El formulario se puede

For Spanish-speaking individuals and businesses, it is essential to have access to the necessary tax forms in their preferred language. The IRS provides a W-9(SP) form, which is the Spanish version of the W-9 form. This printable form includes all the necessary fields required by the IRS to collect tax information. By having access to a printable W-9(SP) form, Spanish-speaking individuals can accurately submit their tax information in their preferred language and ensure compliance with the IRS regulations.

For Spanish-speaking individuals and businesses, it is essential to have access to the necessary tax forms in their preferred language. The IRS provides a W-9(SP) form, which is the Spanish version of the W-9 form. This printable form includes all the necessary fields required by the IRS to collect tax information. By having access to a printable W-9(SP) form, Spanish-speaking individuals can accurately submit their tax information in their preferred language and ensure compliance with the IRS regulations.

Printable W-9 Form Free

When it comes to completing tax forms, finding free and reliable resources is essential. A printable W-9 form is available free of charge on various websites. This allows individuals and businesses to access the necessary form without any financial burden. By utilizing a printable W-9 form for free, you can ensure that you have the correct form to provide accurate tax information and comply with the IRS regulations without incurring any additional expenses.

When it comes to completing tax forms, finding free and reliable resources is essential. A printable W-9 form is available free of charge on various websites. This allows individuals and businesses to access the necessary form without any financial burden. By utilizing a printable W-9 form for free, you can ensure that you have the correct form to provide accurate tax information and comply with the IRS regulations without incurring any additional expenses.

In conclusion, understanding the importance of the W-9 form and having access to printable versions is crucial for individuals and businesses alike. Whether you choose to fill out the form manually or utilize digital platforms, ensuring the accuracy of the information you provide is essential to remain compliant with the IRS regulations. By utilizing the available resources, such as the printable W-9 forms mentioned above, you can streamline the tax filing process and focus on growing your business or managing your personal finances effectively.