Today, I want to share some important information regarding the IRS Form W-9 and the USCIS Form I-9. These forms play a crucial role in various aspects of employment and financial transactions. So, let’s dive right into it!

IRS Form W-9

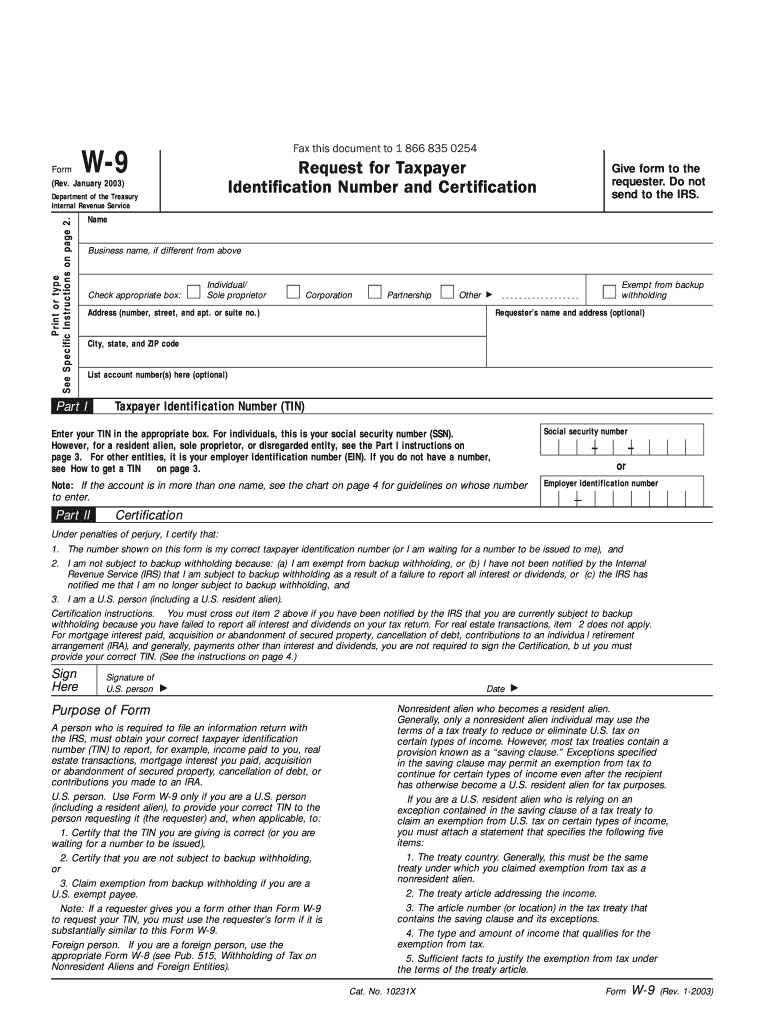

The IRS Form W-9 is a fundamental document used for tax purposes in the United States. It is used to gather essential information from individuals or businesses who are classified as independent contractors or freelancers. The purpose of this form is to collect the taxpayer identification number (TIN) of the individual or business to whom payment will be made.

The IRS Form W-9 is a fundamental document used for tax purposes in the United States. It is used to gather essential information from individuals or businesses who are classified as independent contractors or freelancers. The purpose of this form is to collect the taxpayer identification number (TIN) of the individual or business to whom payment will be made.

The form is quite straightforward to fill out. It requires basic information such as the name, address, and TIN of the individual or business. It also includes a certification section where the individual or business verifies that the TIN provided is correct and that they are not subject to backup withholding.

USCIS Form I-9

The USCIS Form I-9, also known as the Employment Eligibility Verification form, is vital for employers to ensure that their employees are eligible to work in the United States. This form is mandatory for all employers to complete for each employee hired, regardless of their nationality or citizenship status.

The USCIS Form I-9, also known as the Employment Eligibility Verification form, is vital for employers to ensure that their employees are eligible to work in the United States. This form is mandatory for all employers to complete for each employee hired, regardless of their nationality or citizenship status.

The purpose of the Form I-9 is to verify the identity and employment authorization of every individual that is hired. It requires employees to provide specific documents that establish their identity and employment eligibility, such as a U.S. passport, permanent resident card, or employment authorization document.

Importance of Form W-9 and Form I-9

Both the IRS Form W-9 and the USCIS Form I-9 serve critical purposes in different areas.

For businesses, obtaining a completed Form W-9 from independent contractors is crucial before making any payments. The information provided on this form allows businesses to accurately report payments to the IRS and other tax authorities. It also ensures compliance with tax laws and reduces the risk of penalties or legal issues.

On the other hand, the Form I-9 helps employers maintain a legal workforce. By verifying the identity and employment eligibility of their employees, employers demonstrate their commitment to hiring individuals who are authorized to work in the United States. Failure to properly complete and retain the Form I-9 can result in significant fines and penalties for employers.

Conclusion

As you can see, the IRS Form W-9 and the USCIS Form I-9 are essential documents that facilitate compliance with tax and immigration regulations in the United States. By understanding the purpose and importance of these forms, individuals and businesses can ensure that they meet all legal requirements.

Remember, it is crucial to stay updated with the latest versions of these forms, as they may undergo revisions periodically. Always refer to official sources or consult with professionals to obtain the most accurate and up-to-date information.

Complying with tax and employment regulations not only helps individuals and businesses avoid legal issues but also contributes to a fair and transparent economy. So, if you ever come across the need to complete these forms, do so diligently and provide accurate information to fulfill your obligations as a responsible taxpayer or employer.